🔥Cyclical stocks investment secrets: Understanding economic cycles to capture opportunities

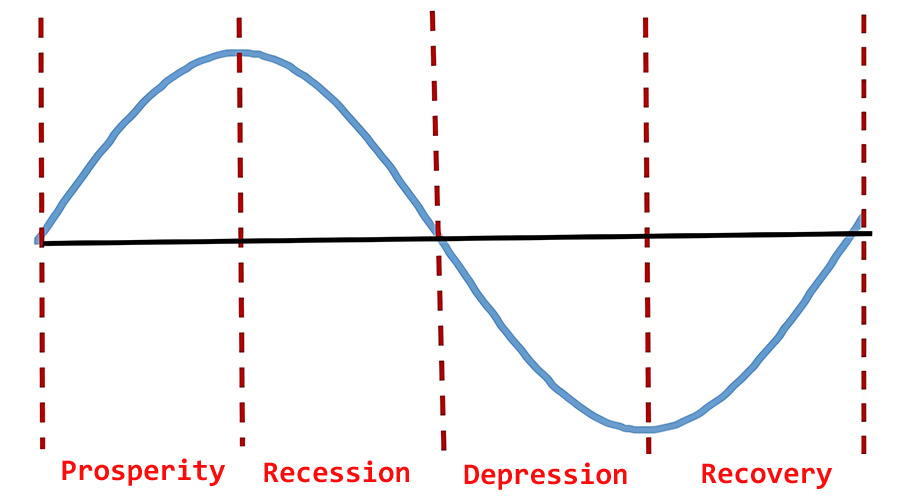

The business cycle refers to the fluctuations experienced by the economic activities of a country or region over time, typically encompassing stages of economic expansion, peak, recession, and trough.

Specifically, the business cycle primarily encompasses the following four stages:

Stage of Economic Prosperity

Economic Prosperity Characteristics: During this stage, economic activities thrive, with growth in output and employment rates. Corporate profits increase, investment activities boom, and the economy is buoyant. Unemployment rates decline, and rising incomes lead to increased consumer spending, boosting social purchasing power. Markets are vibrant, with demand outstripping supply, causing product prices to rise. Market expectations improve, enhancing corporate investment willingness. Production expands rapidly, and business operations scale up significantly (expanding capacity), accompanied by notable increases in investment amounts and soaring profits. Commercial banks also enjoy their peak asset sizes and profits.

Economic Prosperity Manifestations: Rapid expansion in production, investment, and credit; increased employment; willingness to borrow and invest; and an optimistic outlook among the public towards the future economy.

Stage of Economic Recession

Economic Recession Characteristics: Economic activities gradually weaken, with declining output and employment rates. Corporate profits shrink, and investment activities falter, leading to slower economic growth. Unemployment rates rise, consumer demand begins to dwindle, causing unsold goods and excess capacity that triggers price wars. Corporate profits plunge drastically, with some enterprises facing cash flow difficulties or even incurring losses, thereby severely reducing the liability scale of commercial banks. In severe cases, some enterprises go bankrupt, increasing bad loans and leading to loan contraction by banks.

Economic Recession Manifestations: Slowing or stagnant economic growth, substantial declines in corporate profits, widespread unemployment, steep drops in yield curves, and declining consumer spending willingness (due to a combination of low cash reserves, high debts, asset sales to repay debts, and subsequent asset price declines).

Stage of Economic Depression

Economic Depression Characteristics: Economic activities slow down to their lowest point, with low incomes and employment levels. Production, investment, and credit tighten significantly, resulting in severe unemployment and a pessimistic outlook among the public. The nadir of the depression is known as the trough, where employment and output reach their lowest points. Both supply and demand are at low levels during this stage, particularly as economic prospects remain uncertain, leading to insufficient social demand, asset depreciation (with asset prices falling below their intrinsic values), and stubbornly high unemployment rates.

Economic Depression Manifestations: Tightening in production, investment, and credit; severe unemployment; and significant declines in asset prices.

Stage of Economic Recovery

Economic Recovery Characteristics: Economic activities gradually resume, with employment rates starting to grow and corporate profits improving. Investment activities rebound, and the economy gradually emerges from the trough. Public confidence in the market revives, stimulating increased corporate investment intentions. Firms commence expanding investments and updating fixed assets, normalizing production and operation activities, and significantly expanding the demand for loan funds. The asset business scale and profits of commercial banks also expand markedly.

Economic Recovery Manifestations: The economy recovers from the trough but has yet to reach its peak. People's confidence gradually restores, and lending, factory construction, consumption, and investment activities gradually increase (i.e., people regain the courage to borrow, build factories, consume, and invest).

These four stages of the business cycle are interconnected and alternate in economic activities, forming the fluctuations of the business cycle. It's crucial to note that the stages do not necessarily occur in strict chronological order, and their duration and intensity can vary due to various factors. Furthermore, the business cycle can be categorized into long, medium, and short cycles, with different time spans ranging from as long as 8-10 years to as short as 3-5 years.

Indicators of Turning Points in Cyclical Stocks within the Business Cycle

When investing in cyclical stocks, investors often choose to buy when even the best companies in the industry are losing money and sell when even the worst are profitable. Investors should be vigilant when the following situations arise:

- The original industry expands capacity, making future overcapacity likely.

- Cross-industry capital influx indicates lowering barriers to entry, severe homogenization, and exacerbated overcapacity.

- Some industry players unable to withstand pressure start cutting prices, triggering a price war across the entire sector.

tags:

How economic cycles impact investment strategies for cyclical stocks?

Investment opportunities in cyclical stocks amid economic cycle fluctuations

Economic Cycles and Cyclical Stocks: Uncovering the Periodic Booms and Busts in the Stock Market

Comments (0)