🔥Why should medium and short-term investors stay away from heavy asset industries?

What is a heavy asset industry?

A heavy asset industry refers to those sectors that require substantial capital investment, possess a long return cycle, and necessitate robust financial strength. These industries typically exhibit the following notable characteristics:

Large Capital Requirements and Prolonged Investment Cycles

Heavy asset industries necessitate the purchase of significant fixed assets such as machinery, factory buildings, and production lines, often involving investments in the billions, forming the core asset base of enterprises. Due to the need for infrastructure development, equipment procurement, and raw material acquisition, the investment cycle in heavy asset industries is typically extensive. Companies must possess sufficient patience and financial prowess to sustain these long-term investments.

Some companies resort to various means to raise funds repeatedly from the stock market, including issuing corporate bonds, targeted share offerings, and equity pledges, further diluting the interests of existing shareholders. After securing substantial funds, some management teams may engage in risky behaviors, divert funds, and flee, with numerous such cases documented in the A-share market.

Lengthy Return Cycles and High Risks

Given the scale and duration of investments in heavy asset industries, the return cycles are correspondingly long. Companies must demonstrate patience and strategic vision to navigate the extended investment-to-return timeline. Missteps in decision-making, such as blind expansion, can lead to overcapacity, inventory pile-ups, bad debt provisions, price wars, and other adverse outcomes.

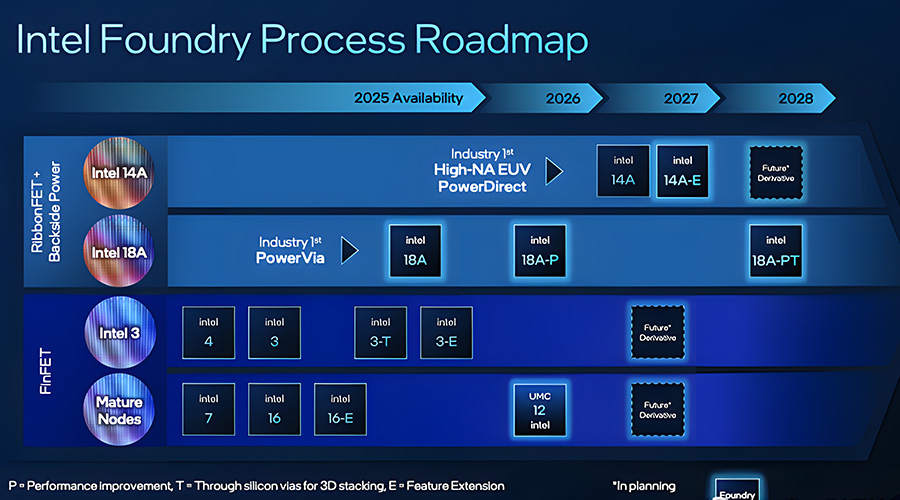

Rapid Technological Iteration and Extensive Resource Investment

Heavy asset industries often necessitate a high technological content, particularly in modern manufacturing, where sophisticated machinery and skilled R&D personnel are essential. This necessitates continuous investments in funds, technology, time, and human resources.

High Proportion of Fixed Assets

The assets of heavy asset enterprises are primarily long-lived fixed assets, which typically constitute a significant portion of their total assets. The maintenance and upgrading of these fixed assets are crucial components of their operations.

Typical Examples of Heavy Asset Industries

Manufacturing: From automobile manufacturing to electronics production, manufacturing enterprises continually invest heavily in maintaining and upgrading their production equipment, factories, and production lines.

Real Estate: Involving substantial capital outlays for land acquisition, property construction, and infrastructure development, these investments are directed towards real estate acquisition and long-term investments.

Transportation: Sectors like aviation, railways, and road transportation necessitate substantial investments in transportation means, infrastructure, and related maintenance expenses.

Infrastructure Construction: Industries like power, water utilities, and telecommunications engage in extensive equipment procurement, infrastructure construction, and maintenance to ensure stable public service delivery.

In summary, while heavy asset industries tend to be stable in the long run, they are susceptible to short-term economic fluctuations, policy adjustments, and market cycles, resulting in poor liquidity and unstable returns. During economic downturns, medium and short-term investors should actively avoid heavy asset industries, as their market recovery cycles are significantly longer than those of light asset industries.

Comments (0)