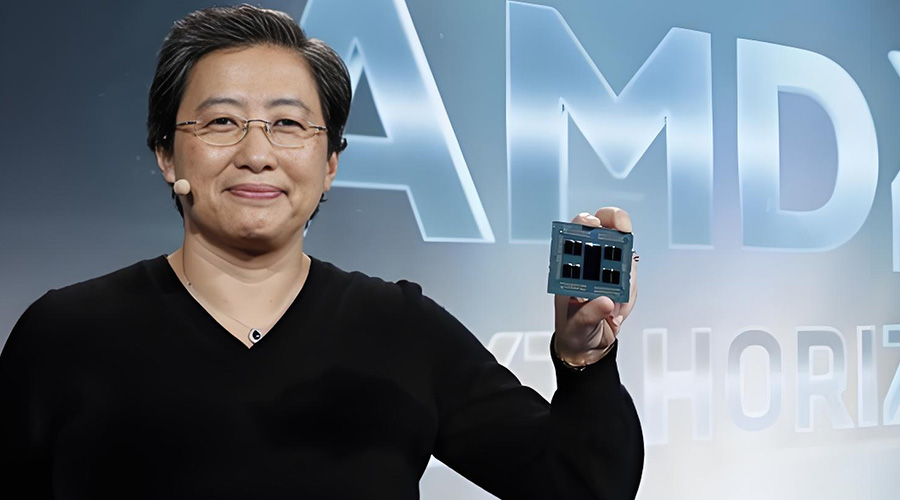

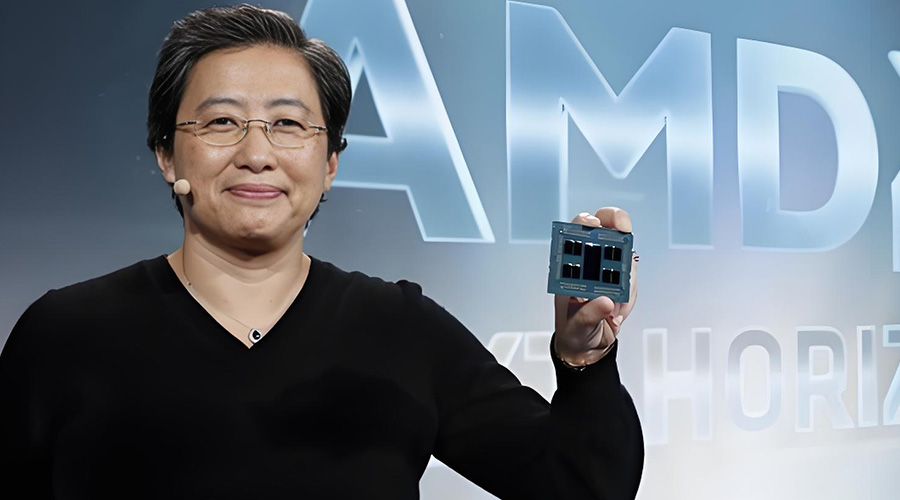

AMD's rating was downgraded, resulting in a sharp decline of 5.57%

2024.12.09, Bank of America Corp(NYSE:BAC) unexpectedly downgraded Advanced Micro Devices Inc(NASDAQ:AMD)'s stock rating to "Neutral" and lowered its target price from $180 to $155, making AMD a focal point of market attention, with its share price closing down 5.57%. This move was due to concerns about the outlook for AMD's artificial intelligence and personal computer chip businesses, with a significant decline in related revenues expected in 2025. In contrast, Bank of America maintained a "Buy" rating for NVIDIA Corporation(NASDAQ:NVDA) and Broadcom Inc(NASDAQ:AVGO).

Analysts pointed out that AMD has failed to shake NVIDIA's market share and faces competitive pressure from customized AI chips by Broadcom and Marvell(NASDAQ:MRVL), limiting its growth potential. Bank of America lowered its revenue forecast for AMD's data center AI chips in 2025 to $8 billion, below Wall Street expectations. Meanwhile, executives at cloud computing giant AWS stated that demand for AMD chips is not strong, while demand for NVIDIA and self-developed chips remains robust. Additionally, adjustments in personal computer market demand in the first half of 2025 are expected to adversely affect AMD's PC business.

Comments (0)