Classification of bonds

Generally speaking, bonds can be categorized into treasury bonds, municipal bonds, and corporate bonds based on the issuing entity.

Treasury Bonds

Treasury bonds, also known as sovereign bonds, are issued by sovereign nations and typically guaranteed by the national credit, making them carry a very low default risk.

Among them, U.S. Treasury bonds are widely regarded as an extremely safe investment option, serving as a haven for governments, institutional investors, and individual investors alike. Especially during economic uncertainties or crises, investors tend to allocate funds into the U.S. Treasury bond market as a risk-averse choice. The characteristics of Treasury bonds often include:

- Extremely low credit risk: U.S. Treasury bonds are generally considered the lowest-risk investment due to the excellent creditworthiness of the U.S. government, with virtually no default risk.

- Fixed interest rates: U.S. Treasury bonds typically offer fixed interest rates, allowing investors to know their future interest payments at the time of purchase.

- High liquidity: The U.S. Treasury bond market is highly active and easily tradable, thus ensuring high liquidity.

Municipal Bonds

Municipal bonds, issued by local governments or their financing platforms, rely primarily on the credit of the local government as the repayment source, offering investors a certain return. These bonds are often used to finance infrastructure, public facilities, and other public welfare projects, serving as one of the primary means for local governments to raise funds.

The characteristics of municipal bonds typically include:

- Tax-exempt interest: U.S. municipal bonds usually enjoy federal income tax exemption, attracting investors, especially those residing within the respective local government jurisdictions.

- Varying interest rates by region: Interest rates and credit ratings of municipal bonds can differ across regions, resulting in varying risks and returns.

Corporate Bonds

Corporate bonds, also known as debentures, are issued by companies. Investors holding these bonds essentially lend money to the company and receive a debt instrument in return. The primary purpose of issuing corporate bonds is to raise funds, which can be used for various purposes such as expanding production, developing new products, or repaying other debts.

The characteristics of corporate bonds typically include:

- Diversity: The corporate bond market encompasses various types of bonds with different credit ratings and interest rates, catering to the needs of diverse investors.

- Company-specific risks: The credit risks of different companies vary, requiring investors to assess risks based on the company's credit rating.

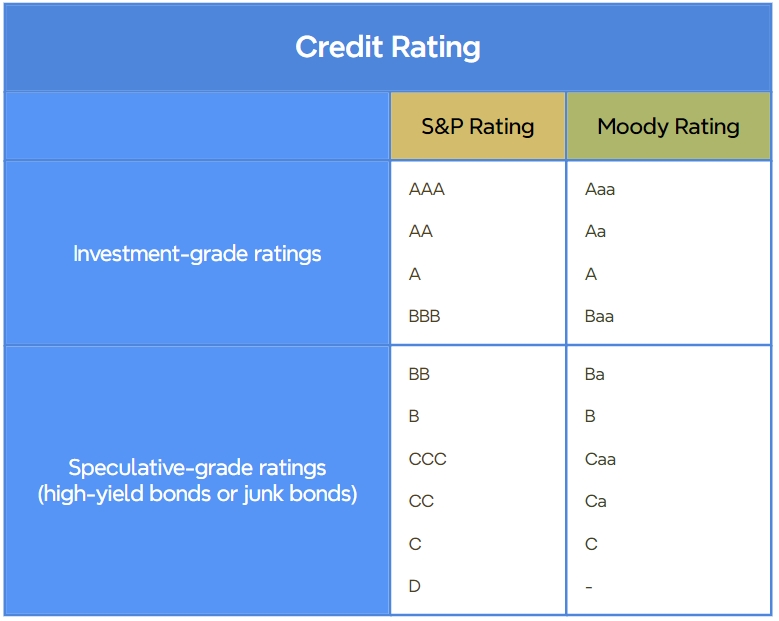

What is Credit Rating?

Essentially, a credit rating assesses the ability of a bond-issuing entity to make timely payments of principal and interest. Nobody wants to deal with defaulters, hence credit ratings serve as a crucial indicator for deciding whether to invest in a particular bond.

In the United States, major rating agencies include Standard & Poor's (S&P), Moody's, and Fitch Ratings.

Credit ratings are primarily divided into two categories: Investment Grade and Non-Investment Grade (aka Speculative Grade).

- Investment-grade ratings typically range from "AAA" (or equivalent) to "Baa" (or equivalent). Investment-grade bonds generally carry lower credit risks and, consequently, offer relatively lower interest rates. Their low-risk nature attracts numerous investors, including pension funds and insurance companies.

- Speculative-grade ratings, on the other hand, range from "Ba" (or equivalent) to "D" (default). Speculative-grade bonds, often referred to as high-yield bonds (or junk bonds), offer higher interest rates but also entail higher credit risks. These bonds are more prone to default risks but attract investors seeking higher returns.

Take a break

👉👉👉 【BTTH Year EP102】The Four Pavilions Grand Meeting began, Xiao Yan rescued Lin Yan