Product selection and investment strategy

Types of US Treasury Securities

When it comes to investing in US Treasury securities, what types of products can investors choose from? For average investors, two common types of Treasury securities are: US Treasury bonds and US Treasury ETFs.

US Treasury Bonds. Investing in US Treasury bonds offers numerous advantages, such as:

- Low Credit Risk: US Treasury bonds are issued by the US government and are considered to be default-free. The US government possesses an extremely high repayment capacity, hence investors needn't worry about bond defaults. Moreover, since their inception, US Treasury bonds have never defaulted.

- High Liquidity: The US Treasury bond market is one of the largest bond markets globally, with exceptional liquidity. This means that you can buy and sell US Treasury bonds more easily without worrying about significant transaction costs.

- High Market Transparency: The US Treasury bond market is highly transparent, allowing you to easily access bond information, including prices, interest rates, and maturity dates, on various stock trading platforms.

US Treasury ETFs. Apart from individual bonds, US Treasury ETFs (Exchange-Traded Funds) are also suitable bond options for novice investors. Firstly, an US Treasury ETF is an open-end fund that invests in various types of bonds. Unlike mutual funds, you can trade them freely like stocks. Advantages of US Treasury ETFs include:

- Diversification: US Treasury ETFs typically comprise multiple bonds of varying types and maturities, spanning from short-term to long-term, including Treasury bills to inflation-protected securities, providing diversified investment and mitigating the impact of specific bond defaults.

- Ease of Trading: Buying and selling US Treasury ETFs is more convenient than purchasing and holding individual bonds. You can find suitable US Treasury ETFs on the Tiger Trade App and execute transactions swiftly.

- Low Entry Barrier: Purchasing individual bonds often requires buying an entire bond, with potentially high face values. For instance, acquiring a $1,000 US Treasury bond necessitates a $1,000 or more investment. In contrast, buying US Treasury ETFs allows you to invest with less capital, selecting the number of shares based on your financial situation.

Simple Strategies for Investing in US Treasury Securities

After understanding how to choose suitable US Treasury products, let's delve into two simple investment strategies.

Buy-and-Hold Strategy. Let's start with the simplest, the "buy-and-hold" strategy. This relatively traditional bond investment approach involves purchasing bonds and holding them until maturity. Key aspects of this strategy include:

- Fixed Interest Income: Typically, bonds generate fixed interest income. These payments provide stable cash flows, ideal for investors seeking steady income, such as retirees.

- Principal Recovery: Upon maturity, the issuer repays the bond's face value, returning the original investment (barring defaults). This ensures investors recoup their capital if held to maturity.

- Low Risk Appetite: Compared to other asset classes, bonds generally carry lower risks, and maturity principal repayments are highly predictable.

- Simplified Investing: This strategy is straightforward, requiring minimal trading decisions. Investors buy bonds, collect regular interest payments, and wait for maturity.

In summary, the buy-and-hold strategy suits investors with long-term goals, a preference for stable income, and tolerance for some price fluctuations.

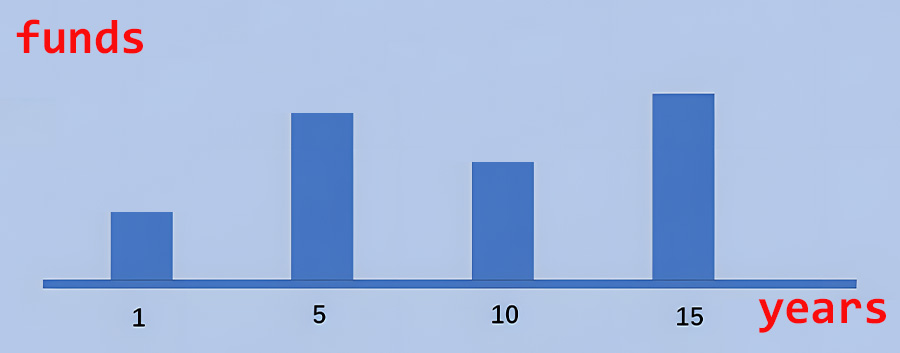

Laddered Bond Portfolio Strategy. The "laddered bond portfolio" strategy further refines the buy-and-hold approach, making bond investments more purposeful. Simply put, this strategy involves holding bonds with multiple maturities, arranged in a ladder format. This facilitates the diversification of interest rate risk and reinvestment risk, as investors can reinvest upon bond maturities based on current market rates.

Implementation involves purchasing bonds with one-year, five-year, ten-year, and fifteen-year maturities, aligning the maturity dates with significant spending milestones. This ensures liquidity while generating returns. This laddered strategy is well-suited for investors with varied financial timelines, such as those preparing for tuition payments in five years, home replacements in ten years, or retirement income in fifteen years.